oregon statewide transit tax 2021 rate

The tax is one-tenth of one. A Statewide transit tax is being implemented for the State of Oregon.

2018 Form Or Or Stt 2 Fill Online Printable Fillable Blank Pdffiller

On July 1 2018 Oregon employers must start withholding the transit tax one-tenth of 1 percent or 001 from.

. The Oregon Department of Revenue. The 2022 state personal income tax brackets. The transit tax will include the following.

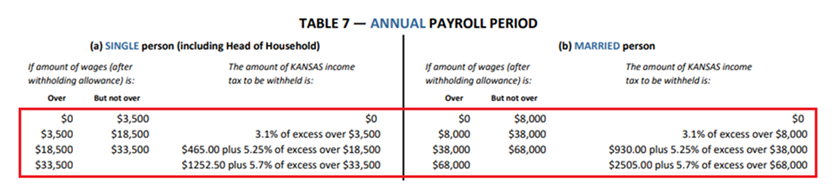

2021 2020 2019 2018 TriMet 0007837 0007737 00076370007537 LTD 00076 00075 00074 00073 Payroll transit tax All employers who pay wages for services per. Cigarette and tobacco products tax. The Oregon transit tax is a statewide payroll tax that employers withhold from employee wages.

Before the official 2022 Oregon income tax rates are released provisional 2022 tax rates are based on Oregons 2021 income tax brackets. Oregon Statewide Transit Tax Rate 2021 will sometimes glitch and take you a long time to try different solutions. Oregon salary tax calculator for the tax year 202122.

Oregon Transit Payroll Taxes for Employers If you use a payroll service or a tax preparer please be sure your preparer is filing and depositing. 04-09-20 o R--1 o 2021 Form OR-STT-1 Oregon Quarterly Statewide Transit Tax Withholding Return Instructions General information The new statewide. TriMet Transit District rate 1114 to 123115.

This change is effective for calendar year 2019. Help users access the login page while offering essential notes during the login process. Oregon withholding tax tables.

LoginAsk is here to help you access Oregon Statewide Transit Tax Rate. Statewide Transit Tax Statewide Transit Tax Statewide Transit Tax Starting July 1 2018 youll see a new item on your paystub for Oregons statewide transit tax. Page 1 of 1 150-206-003-1 Rev.

Check the box for the quarter in which the statewide transit tax. Transient lodging administration page. The Oregon State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Oregon State Tax Calculator.

The detailed information for Oregon Transit Tax Rate 2021 is provided. Oregon Quarterly Statewide Transit Tax Withholding Return Office use only Page 1 of 1 150-206-003 Rev. Transient lodging administration page.

Oregon Income Tax Calculator 2021. What are the tax rates. Oregon State Transit.

There is no maximum wage base. Formulas and tables. Your average tax rate is 1198 and your marginal tax rate is.

Oregon employers are responsible for withholding the new statewide transit tax from employee wages. Help users access the login page while offering essential notes during the login process. If you make 70000 a year living in the region of Oregon USA you will be taxed 15088.

Ezpaycheck How To Handle Oregon Statewide Transit Tax b 500000 or. Cigarette and tobacco products tax. Tax rate used in calculating Oregon state tax for year 2021.

Formulas and tables. Oregon employers must withhold 01 0001. Oregon withholding tax tables.

Starting July 1 2018 the tax which is one-tenth of 1 percent or 0001 must be. Beginning with returns filed in January 2021 businesses and payroll service providers will have the ability to file the Statewide Transit Tax returns in bulk. The detailed information for 2020 Oregon Transit Tax Rate is provided.

The tax rate is 010 percent.

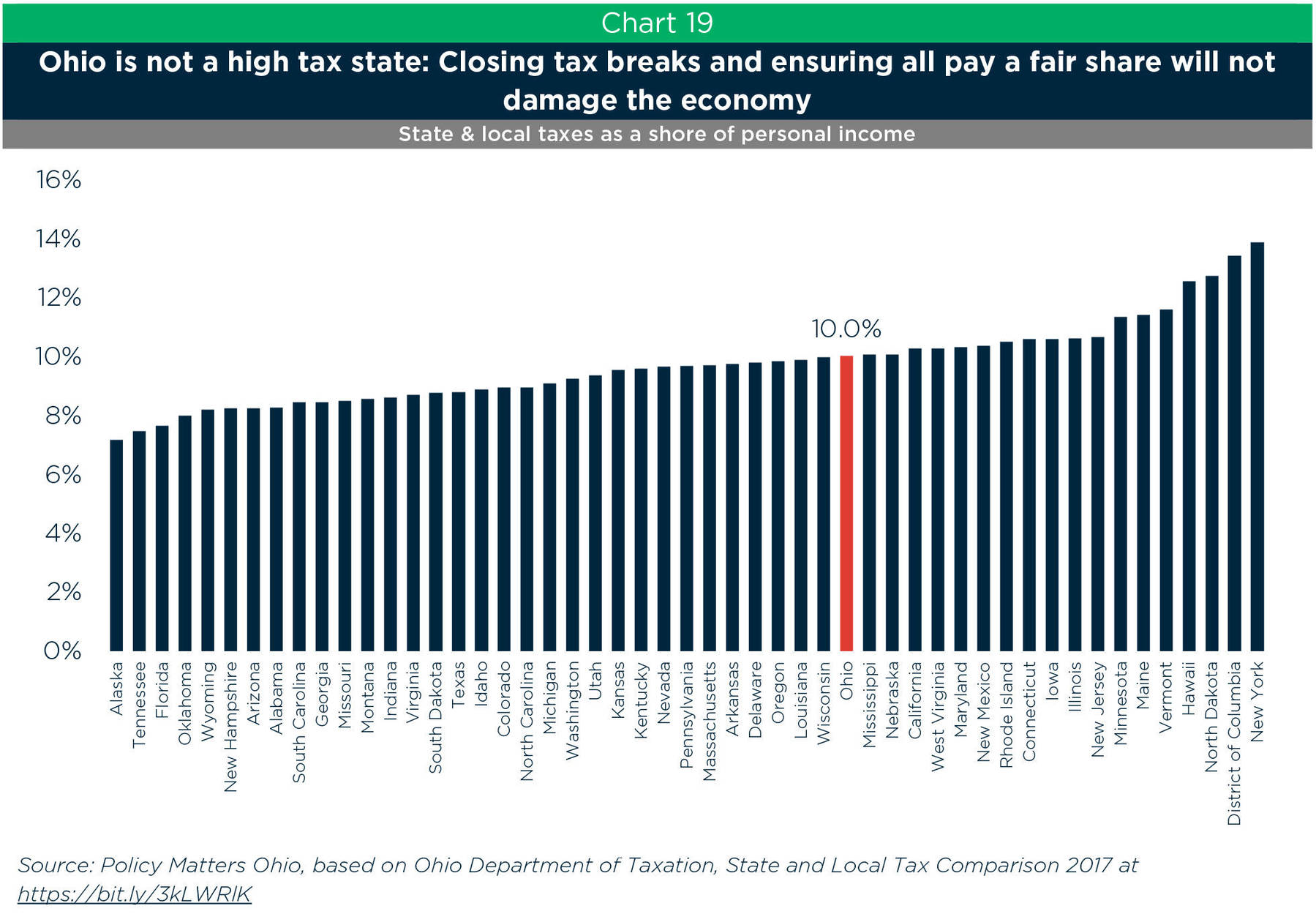

The Ohio 2022 2023 State Budget

Oregon Income Tax Calculator Smartasset

The Trimet Self Employment Tax Solid State Tax Service

Motor Fuel Taxes Urban Institute

Payroll Systems Attn Oregon Statewide Transit Tax Effective July 1 Payroll Systems

2021 Payroll In Excel Oregon State Transit Workers Benefit Fund Edition Youtube

2021 Payroll In Excel Oregon State Transit Workers Benefit Fund Edition Youtube

What Are State Payroll Taxes Payroll Taxes By State 2022

2021 2022 Tax Year End Wicks Emmett Cpa Firm

U S Tax Reporter Year End 2021 Sap Blogs

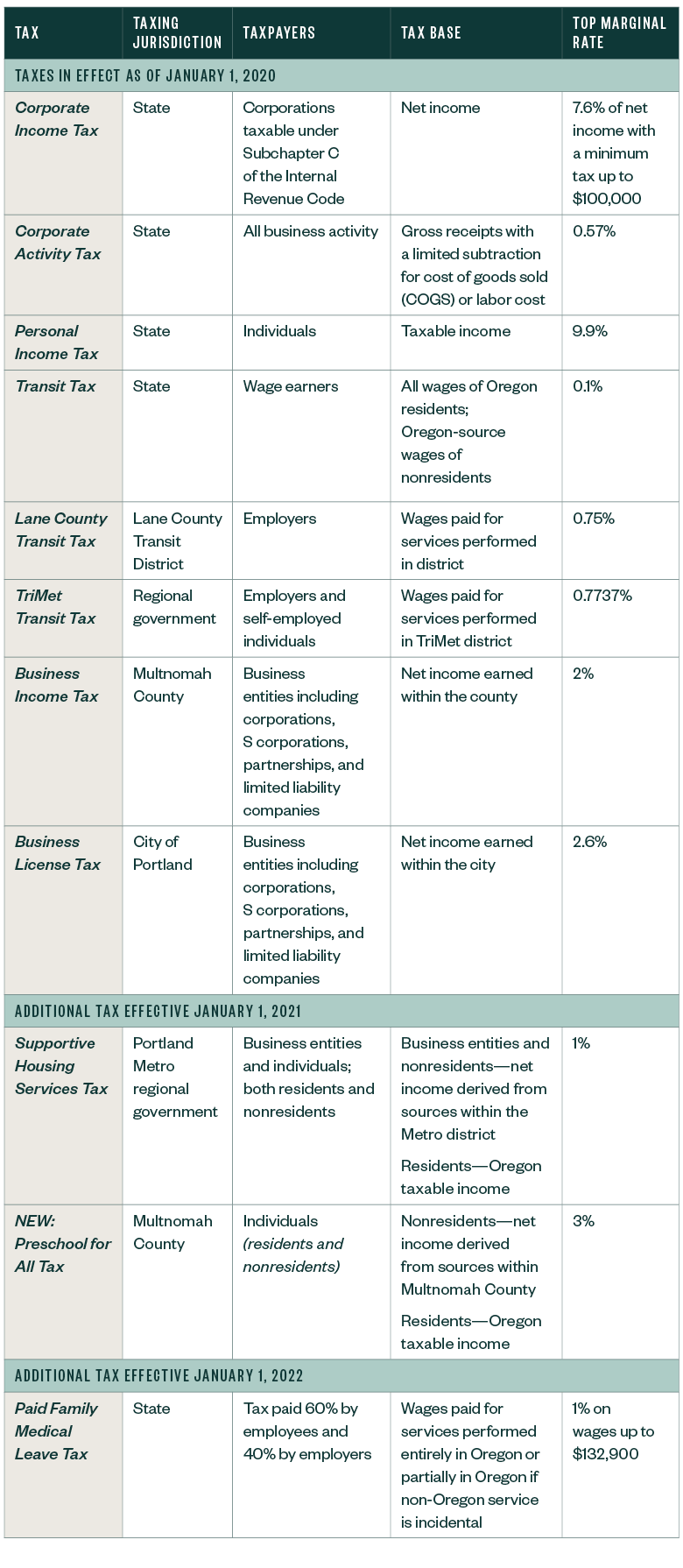

New Portland Tax Further Complicates Tax Landscape

Coronavirus Updates Gladstone Oregon

Blog Oregon Restaurant Lodging Association

Sales Taxes In The United States Wikipedia

State Infrastructure Spending State Infrastructure Revenue

Taxes And Racial Equity An Overview Of State And Local Policy Impacts Itep